Learn How We’re Continuing Our Mission – Read the Statement from Our Leadership →

On December 4, 2024 we celebrated a transformative milestone with a special mainstage event. This gathering highlighted stories of impact, key insights, and the opportunities ahead, featuring national speakers and keynote remarks from Appalachian Community Capital President & CEO Donna Gambrell and Appalachian Regional Commission Federal Co-Chair Gayle C. Manchin. The event celebrated Phase II Funding – Open Round for the Green Bank for Rural America and unlocking new funding opportunities for community lenders serving Appalachia and rural communities nationwide.

Phase II funding awards prioritize investments in Appalachia, energy communities, rural communities of color, and Native communities.

Phase I funding provided targeted support to communities hardest hit by Hurricane Helene.

December 5, 2024: Mastering the Application Process

December 6, 2024: Community Engagement Session with WV Community Development Hub

December 13, 2024: Workforce Development Session with Coalfield Development Corporation

The Green Bank for Rural America is a wholly-owned subsidiary of Appalachian Community Capital (ACC), a regional Community Development Financial Institution (CDFI). CDFIs share a common goal of expanding economic opportunity by increasing access to financial products and services in communities underserved by traditional financial institutions. ACC received its CDFI certification from the U.S. Department of the Treasury in 2016. Its mission is to provide its 37 Appalachian and five national member institutions with new sources of capital so they can increase small business lending and strengthen the economy in the communities they serve. The members – many of whom have been in operation for more than 20 years – and their affiliates manage over $2 billion in assets supporting economic development in Appalachia.

On August 16, 2024, ACC announced the creation of the Green Bank for Rural America, an ambitious initiative to provide public and private capital that enables rural areas to gain the most benefit from the new energy economy. Beginning with a $500 million award from the U.S. Environmental Protection Agency’s Greenhouse Gas Reduction Fund (GGRF), the Green Bank is set to drive new and renewed economic opportunity in Appalachia and communities across rural America.

The Green Bank for Rural America is a hub for investment and technical assistance to community lenders, local leaders, businesses, project developers and workforce development partners across the United States.

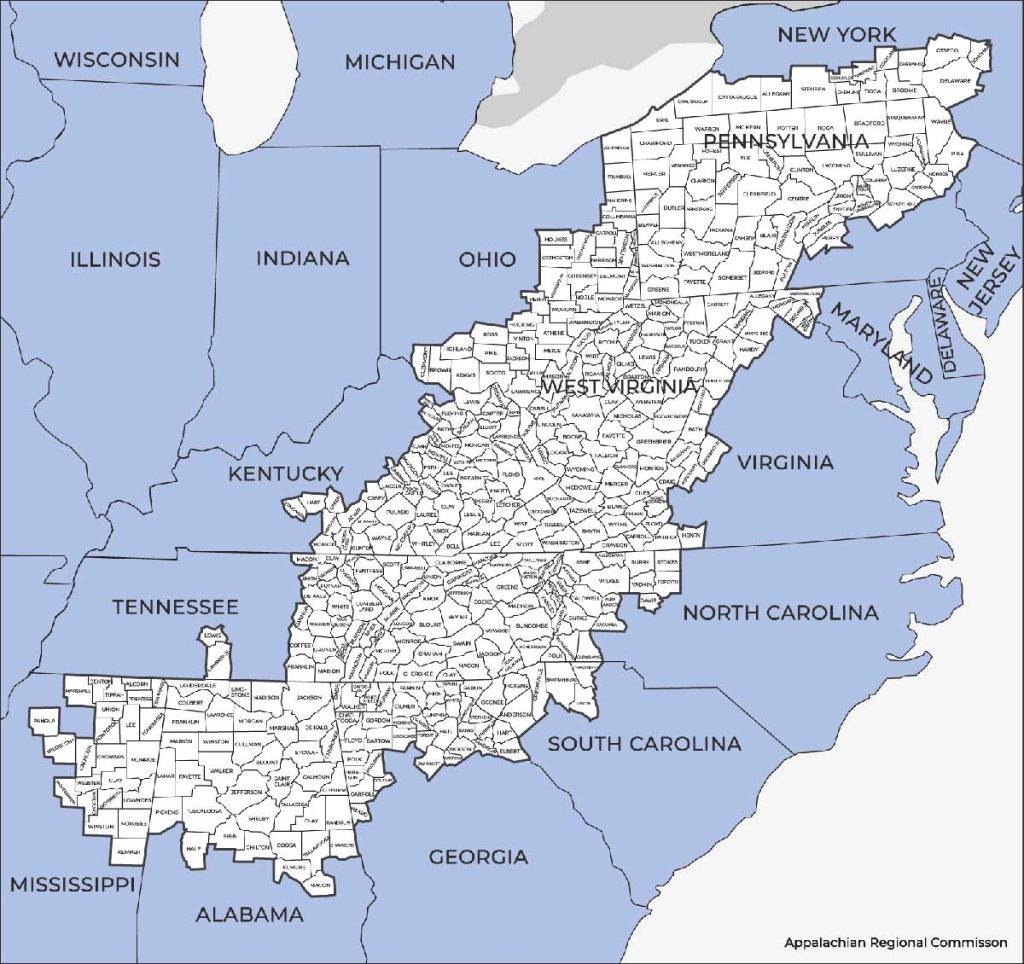

We prioritize investments in 582 counties in Appalachia, energy communities, rural communities of color, and Native communities. Financing and technical assistance will be available in all eligible rural areas nationwide.

Appalachia (Appalachian Regional Commission)

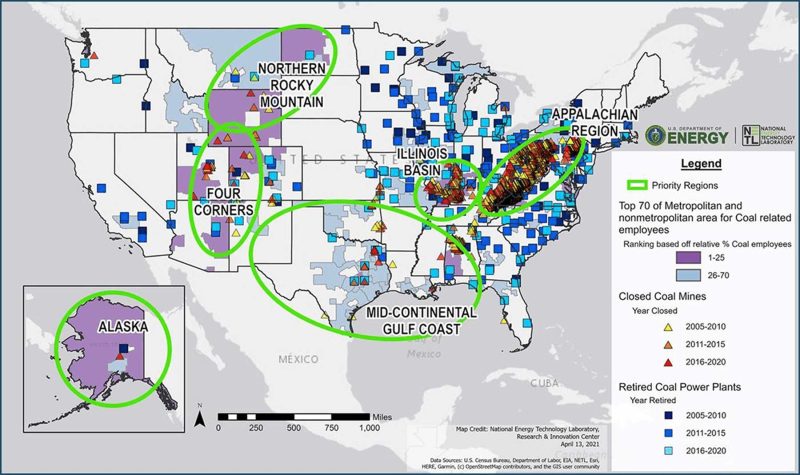

Coal Communities and Power Plant Closures (White House Interagency Working Group)

Communities that receive funding through the GGRF will meet the program’s definitions for Low-Income and Disadvantaged Communities (LIDAC), which are identified by census tract and income status. For more information, please visit our Eligibility Map and data resources below.

GGRF Award Size

Capital Deployment

Total Project Cost

Leveraged Capital

Beginning with our $500 million award from the Environmental Protection Agency, we estimate leveraging private capital to finance $1.6 billion into 2,000 new energy projects, creating 13,000 good jobs and reducing harmful air pollution by up to 850,000 tons each year.

These projects and businesses are anticipated to leverage financing from a range of sources, such as banks, tax credit or other private equity, nonprofit and public sector loan funds, grants from public and private sources, and incentives from utilities or philanthropy.

Having supported thousands of transactions in Appalachia and rural communities, ACC and participating lenders have deep knowledge of community needs and financing opportunities, as well as exceptional expertise at structuring and managing development finance portfolios totaling billions of dollars.

As a result of these investments, we anticipate the following impacts.

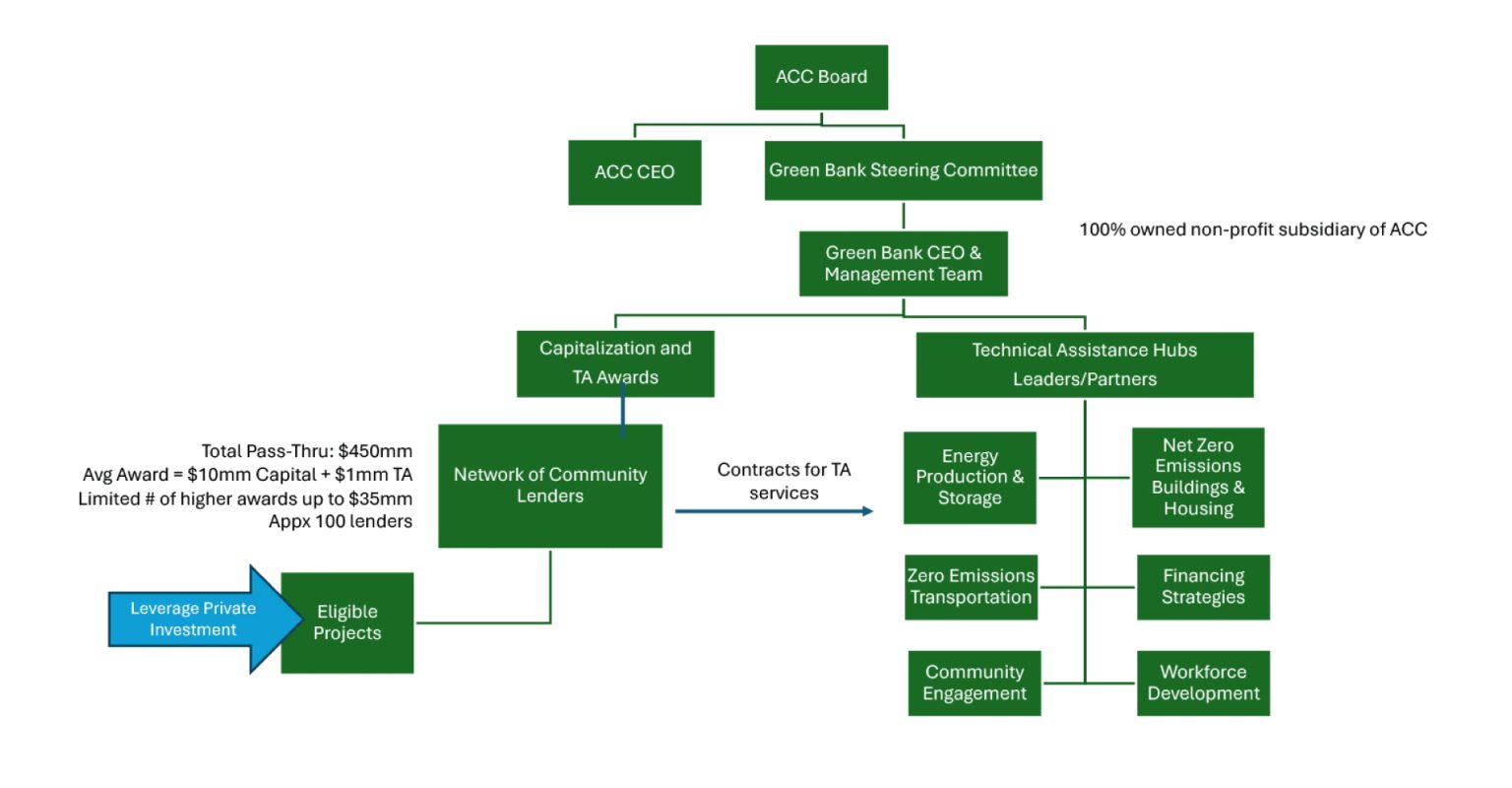

The Green Bank is governed by a steering committee that provides guidance and oversight. Our team oversees and evaluates all financing and technical assistance activities and ensures that all of our activities prioritize community engagement. We also track impacts resulting from our investments, review our activities to ensure they comply with legal and grant requirements, and undertake financial and risk management assessment.

Appalachian Community Capital and Green Bank for Rural America are also raising two funds, seeking private investment, program related investments (PRIs), mission-related investments (MRIs), and grants, to support investing in rural America during and beyond the EPA award timeframe. Powering Rural Opportunities (PRO Fund) will finance projects that fall outside EPA guidelines; and a Participation Facility will provide access to financial markets through loan securitization and other structures.